Interest rate compounded monthly

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Total of 36 Monthly Payments.

The Principal Amount Together With Interest Is Repaid On Maturity Of The Deposit No Interest Is Payable If The Deposit Is Prematur Deposit Bank Interest Rates

Let us determine how much will be daily compounded interest calculated by the bank on loan provided.

. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. It is the basis of everything from a personal savings plan to the long term growth of the stock market. For example consider a loan with a stated interest rate of 5 percent that is compounded monthly.

Mortgage loan basics Basic concepts and legal regulation. I monthly interest rate. What is the future value of an initial investment of 5000 that earns 5 compounded monthly for 10 years.

Fifth multiply 0004867551 by 100 to find that the monthly interest rate equals 04867551. 6 annually is credited as 612 05 every month. What is the compounded annual formula.

Compound interest also accounts for the effects of inflation and repaying debt. The spreadsheet below shows how this calculation can be done on Excel. N is frequency or no.

T is the overall tenure. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Example Lets go back to our previous loan numbers.

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. R is the rate of interest. Investing Quiz Test your knowledge of investing terms.

When calculating interest interest compounding grows faster than at a simple interest rate. A P1rn nt CI A-P Where CI Compounded interest A Final amount P Principal t Time period in years n Number of compounding periods per year r Interest rate. Of times the interest is compounded annually.

Canadian mortgage loans are generally compounded semi-annually with monthly or more frequent payments. Length of time in years that you plan to save. A nominal interest rate of 6 compounded monthly is equivalent to an effective interest rate of 617.

If the time period for the calculation of interest is monthly the interest is calculated for each month and the amount is compounded 12 times a year as there are 12 months in a year. For monthly n12 t the time in years. Income tax rate 25.

For example if the amount owed is 1500 the payment due date is April 1 the agency does not pay until June 15 and the applicable interest rate is 6 interest. Note that the effective interest rate will always be greater than the stated rate. A sum of 1 00000 is borrowed from the bank as a home loan where the interest rate is 5 per annum and the amount is borrowed for a period of 15 years.

If one just made interest-only payments the amount paid for the year would be 12 r B 0. A sum of 4000 is borrowed from the bank where the interest rate is 8 and the amount is borrowed for two years. Interest rate for subsequent years 45.

If you only carry a balance on your credit card for one months period you will be. Your estimated annual interest rate. R the nominal annual interest rate in decimal form.

The second part of the equation calculates simple interest on any additional days beyond the number of months. The same loan compounded daily would yield. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Following is the formula for calculating compound interest when time period is specified in years and interest rate in per annum. After one year the initial capital is increased by the factor 10005 12 10617. Let us find out how much will be monthly compounded interest charged by the bank on loan provided.

Using the formula yields. N number of months required to repay the loan. In finance the duration of a financial asset that consists of fixed cash flows such as a bond is the weighted average of the times until those fixed cash flows are received.

The first 2 years calculation results are as follows. R 1 05365365 - 1 or r 513 percent. Daily interest rate 050365 00013699.

For leap years we would use the same formula as above for daily interest but divide by 366 days instead of 365. In the first year the interest rate of 10 is calculated only from the 10000 principal. Lump sum the borrower would pay 5156 more than one who.

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The APY for a 1 rate of interest compounded monthly would be 1268 1 00112 1 1268 a year. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Length of Time in Years. Interest rate variance range. R 1 051212 - 1 or r 512 percent.

General Compound Interest Formula for Daily Weekly Monthly and Yearly Compounding. The simple annual interest rate is the interest amount per period multiplied by the number of periods per year. When the price of an asset is considered as a function of yield duration also measures the price sensitivity to yield the rate of change of price with respect to yield or the percentage change in price for a parallel.

The compounded annual formula is used to calculate the interest that is earned on an investment over a period of time. The first part of the equation calculates compounded monthly interest. Most formal interest payment calculations today are compounded including.

Now suppose you take out the same loan with the same terms but the interest is compounded annually. Thought to have. Times per year that interest will be compounded.

Free online calculator to find the interest rate as well as the total interest cost of an amortized loan with a fixed monthly payback amount. Lets say you have obtained a 4 interest rate on a 200000 loan the home is priced at 25500 and you put 20 down leaving you with a principal of 200000. Initial interest rate for first 2 years 17.

Say for instance that you are investing 5000 with a 10 annual interest rate compounded semi-annually and you want to figure out the value of your investment after five years. Inflation rate 2. 5 means r005 n the number of compound periods per year eg.

If the annual interest rate you start with is the effective interest rate meaning it already includes the impact of interest being compounded each month throughout the year then the formula gets more complicated. With monthly payments the monthly interest is paid out of each payment and so should not be compounded and an annual rate of 12r would make more sense.

Cbse Class 8 Maths Sample Paper Set 1 Sample Paper Maths Paper Math

5 Ways Math Word Walls Have Changed My Teaching Math Word Walls Math Words Algebra Word Walls

Compound Interest Worksheets In 2022 Compound Interest Word Problems Measurement Worksheets

Exponential Functions Posters Reference Sheets Bundle Exponential Functions Word Problem Worksheets Algebra Lesson Plans

Pin On Hw

Savings Accounts Compound Interest Worksheets Answers

Algebra Word Wall Print And Digital Algebra Word Walls Algebra Word Wall

Much Money You Will Find In Your Bank Account At The End Of 3 Years Simply Copy The Same Formula Compound Interest Excel Formula Interest Calculator

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

Tips For Cracking Aptitude Questions On Simple Compound Interest Https Learningpundits Com Module View 51 Simpl Aptitude Compound Interest Simple Interest

Fin 534 Fin534 Problem Set 2 Answers 2020 Strayer

Calculating Periodic Interest Rate In Excel When Payment Periods And Compounding Periods Are Different Interest Rates Excel Period

How To Solve Compound Interest Problems College Algebra Tips Algebra Help College Algebra Algebra

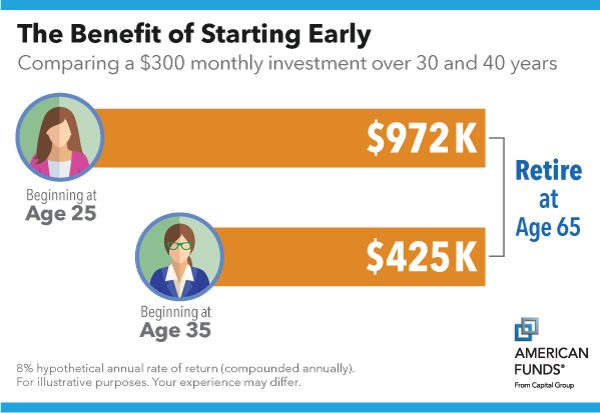

The Benefits Of Starting Early Compoundinterest Financial Education Investing Education

Calculating Periodic Interest Rate In Excel When Payment Periods And Compounding Periods Are Different Interest Rates Excel Period

Ashford Psy 325 Week 4 Assignment Anova Interpretation Exercise Anova Interpretation Writing Center

Pin On Bank Exams Preparation Sbi Po Ibps Clerk